Predatory lending practices target vulnerable borrowers with deceptive loan terms designed to generate maximum profit for lenders while trapping borrowers in unaffordable debt. Recognizing these practices can save you thousands and protect your financial future.

Understanding Predatory Lending

Predatory lending encompasses any lending practice that:

- Imposes unfair or abusive loan terms

- Uses deceptive tactics to conceal true loan costs

- Targets vulnerable populations

- Strips borrower equity through excessive fees

- Ignores borrower's ability to repay

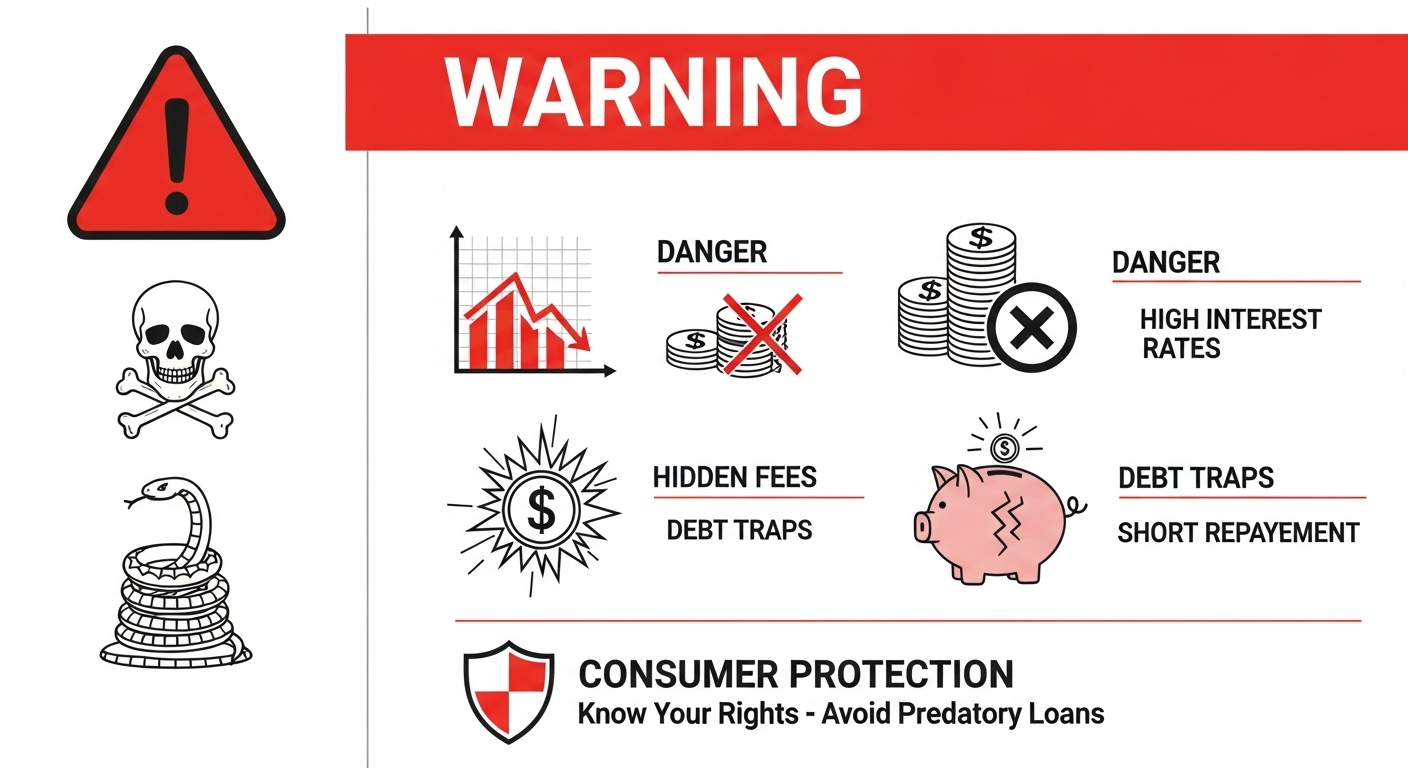

Common Predatory Lending Tactics

1. Excessive Fees and Interest Rates

Predatory lenders often charge fees far above market rates, including:

- Origination Fees: Exceeding 5% of loan amount

- Prepayment Penalties: Lasting longer than 3 years or exceeding 2% of balance

- Interest Rates: Significantly higher than your credit profile warrants

- Hidden Fees: Buried in loan documents or disclosed at closing

- Loan Packing: Adding unnecessary insurance or services

2. Loan Flipping

Repeatedly refinancing loans with high fees, which:

- Reduces your home equity with each refinance

- Increases total debt load over time

- Generates fees for the lender without borrower benefit

- May lead to foreclosure when equity is exhausted

3. Asset-Based Lending

Approving loans based solely on collateral value rather than ability to repay:

- Ignores borrower income and expenses

- Sets up borrowers for default and foreclosure

- Focuses on seizing collateral rather than successful loans

- Violates ability-to-repay regulations

4. Balloon Payments and Loan Terms

Structuring loans with large final payments or short terms that most borrowers cannot afford:

- Interest-only payments leading to large principal balloon

- Short-term loans requiring refinancing

- Adjustable rates with substantial payment increases

- Terms that require refinancing to avoid default

Warning Signs to Watch For

During Marketing and Sales:

- High-pressure tactics: Rushing you to sign without time to review

- Door-to-door solicitation: Legitimate lenders rarely solicit this way

- Guaranteed approval: No credit checks or income verification

- Verbal promises: Terms not reflected in written documents

- Targeting vulnerable populations: Elderly, low-income, or minority communities

During Application and Processing:

- Blank documents: Signing papers with blank spaces

- Falsified applications: Lender encourages inflating income or assets

- No counseling requirement: For first-time borrowers or complex products

- Loan amount pressure: Pushing you to borrow more than needed

At Closing:

- Bait and switch: Terms different from initial proposal

- Last-minute changes: New fees or terms added at signing

- Rush to close: Pressure to sign without reviewing documents

- Missing disclosures: Required forms not provided

Vulnerable Populations

Predatory lenders often target specific groups:

Elderly Homeowners:

- Significant home equity but fixed incomes

- Less familiar with current lending practices

- May be isolated and more trusting

- Targeted for reverse mortgage scams

Minority Communities:

- Historically limited access to mainstream credit

- May face discrimination from traditional lenders

- Often targeted in specific geographic areas

- Higher likelihood of receiving subprime loans

Low-Income Borrowers:

- Limited financial resources and credit options

- May lack financial education or advice

- Desperate for credit during emergencies

- Less likely to shop around for better terms

How to Protect Yourself

Before Applying:

- Shop around: Compare offers from multiple legitimate lenders

- Check credentials: Verify state licensing and Better Business Bureau ratings

- Research market rates: Know current rates for your credit profile

- Get pre-approved: Understand your actual borrowing capacity

During the Process:

- Read everything: Review all documents carefully

- Ask questions: Don't sign anything you don't understand

- Get counseling: Use HUD-approved housing counselors

- Take time: Never rush into signing loan documents

Red Flag Responses:

- Walk away: If pressure tactics are used

- Get second opinions: Consult with other professionals

- Report suspicious activity: Contact regulators immediately

- Document everything: Keep records of all interactions

Legal Protections and Resources

Federal Laws:

- Truth in Lending Act (TILA): Requires clear disclosure of loan terms

- Real Estate Settlement Procedures Act (RESPA): Regulates closing processes

- Dodd-Frank Act: Includes ability-to-repay requirements

- Fair Housing Act: Prohibits discriminatory lending practices

Where to Get Help:

- HUD-approved counseling agencies: Free homebuyer education

- State attorneys general: Investigate predatory lending complaints

- Consumer Financial Protection Bureau: Federal oversight and complaint handling

- Legal aid organizations: Free or low-cost legal assistance

What to Do if You're a Victim

If you've been victimized by predatory lending:

- Stop payments if you're still in the rescission period

- Contact regulators: File complaints with appropriate agencies

- Consult an attorney: Explore legal remedies and damages

- Document everything: Gather all loan documents and communications

- Seek counseling: Get help understanding your options

Remember: You have rights as a borrower, and there are resources available to help protect you from predatory lending practices.