Interest rates serve as the backbone of the financial system, influencing everything from your mortgage payment to retirement savings growth. Understanding these trends empowers you to make strategic financial decisions.

The Ripple Effect of Rate Changes

When interest rates rise, the impacts cascade throughout the economy:

- Borrowing Costs Increase: Mortgages, auto loans, and credit cards become more expensive

- Savings Returns Improve: High-yield savings accounts and CDs offer better returns

- Bond Prices Fall: Existing bonds lose value as new issues offer higher yields

- Stock Market Volatility: Higher rates can reduce corporate profits and stock valuations

Historical Context: Understanding Rate Cycles

Interest rate cycles typically last 3-7 years, driven by economic conditions and Federal Reserve policy. The current rising rate environment follows a decade of historically low rates following the 2008 financial crisis.

Key Historical Periods:

- 1970s-1980s: High inflation led to rates exceeding 18%

- 2000s: Rates fell dramatically during the dot-com crash and 2008 financial crisis

- 2010s: Near-zero rates supported economic recovery

- 2020s: Pandemic-era lows followed by aggressive tightening

Strategic Financial Moves in Rising Rate Environments

For Borrowers:

- Accelerate Major Purchases: Buy before rates rise further

- Refinance Variable Debt: Convert to fixed rates when possible

- Focus on High-Interest Debt: Pay down credit cards and personal loans first

- Consider Shorter Loan Terms: Save on total interest costs

For Savers and Investors:

- High-Yield Savings: Move emergency funds to accounts offering competitive rates

- CD Laddering: Stagger maturities to capture rising rates

- Bond Portfolio Review: Evaluate duration and credit quality

- Dividend Stocks: Look for companies that benefit from higher rates

- Real Estate Investment: Consider how rates affect property values

Sector-Specific Rate Impacts

Banking Industry:

Banks typically benefit from rising rates through improved net interest margins, but may face headwinds from:

- Reduced loan demand

- Increased deposit competition

- Higher credit losses during economic slowdowns

Real Estate:

Higher rates generally cool real estate markets by:

- Reducing buyer purchasing power

- Slowing home price appreciation

- Affecting commercial property valuations

- Impacting REIT performance

Technology Sector:

Growth stocks often struggle with higher rates due to:

- Reduced present value of future earnings

- Higher capital costs for expansion

- Competition from fixed-income investments

Global Rate Considerations

International rate differentials affect:

- Currency Values: Higher U.S. rates typically strengthen the dollar

- International Investments: Currency hedging becomes more important

- Emerging Markets: Higher U.S. rates can trigger capital outflows

- Trade Balances: Strong dollar affects import/export dynamics

Rate Forecasting and Economic Indicators

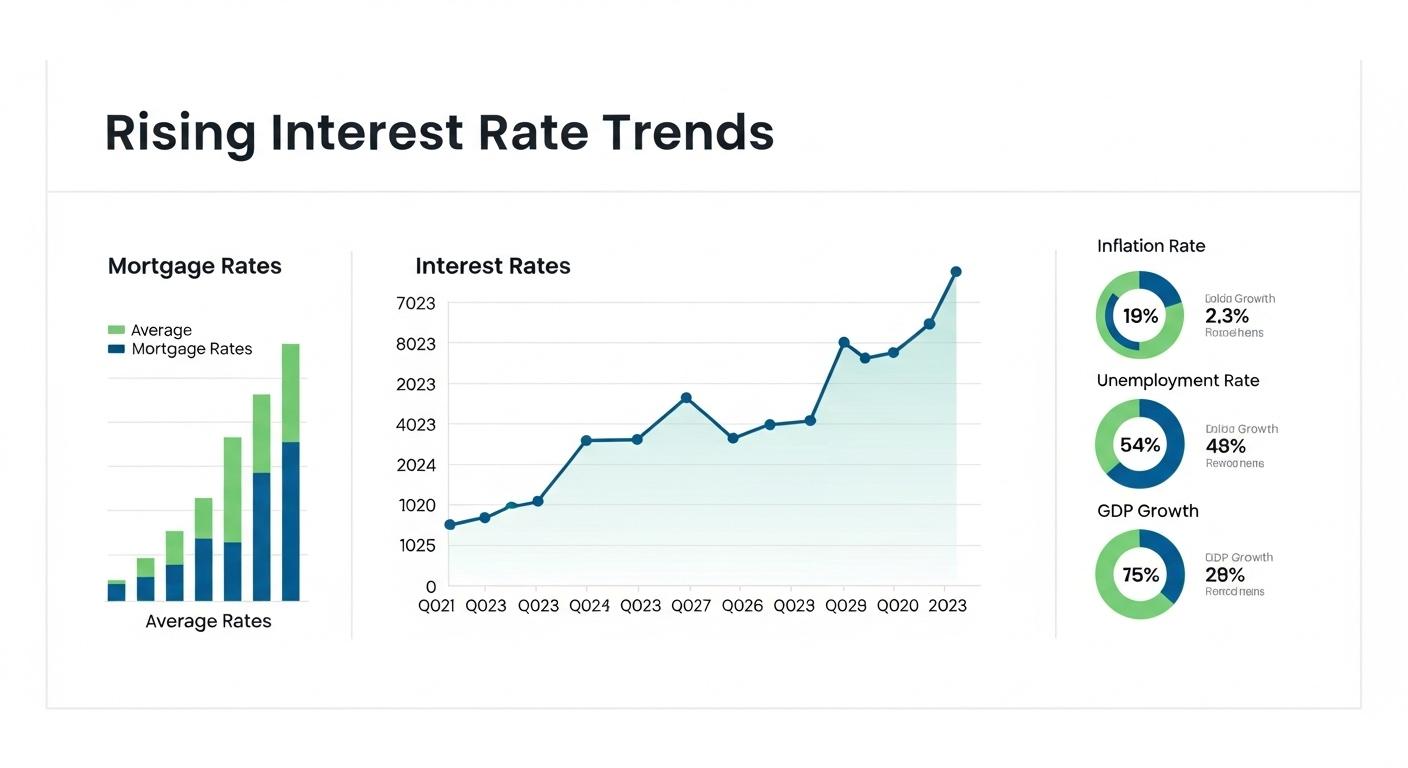

Key indicators to monitor for rate direction include:

- Inflation Metrics: CPI, PCE, and core inflation measures

- Employment Data: Job growth, unemployment rate, wage growth

- GDP Growth: Economic expansion or contraction trends

- Federal Reserve Communications: Meeting minutes, speeches, policy statements

Building Rate-Resilient Strategies

Create financial plans that work across rate environments:

- Diversification: Spread investments across asset classes

- Flexibility: Maintain liquid assets for opportunities

- Regular Review: Adjust strategies as conditions change

- Professional Guidance: Consider working with financial advisors